- NAVERA BUILDERS PVT LTD

- +91 9207601111

- info@naverabuilders.com

Encumbrance Certificate (EC) in Kerala: How to Apply, Download & Check Status?

Encumbrance Certificate (EC) in Kerala: How to Apply, Download & Check Status?

When you are about to buy or sell a property in Kerala, one document that would pop up in the discussions is the Encumbrance Certificate. Even when it is an essential and important document, many buyers and sellers tend to be puzzled by what exactly it means.

This blog will help you understand what an encumbrance certificate is and how to get one. We will also check out how to apply one and what supporting documents would you need for the purpose.

What is an Encumbrance Certificate?

Also called Nil Encumbrance Certificate, EC is an official document issued by the Sub-Registrar Office (SRO) under the jurisdiction of the Registration Department, Government of Kerala. It is a document that provides a detailed record of all registered transactions associated with a specific property over a chosen time period. This period can typically span 13 years to 30 years or even longer.

In fact, it is a legal certification that confirms your ownership title. It also shows whether the property carries any financial or legal liabilities. The said liabilities can include outstanding bank mortgages, lease agreements, court attachments, or other claims that might complicate a property transaction.

Key Purpose of Encumbrance Certificate

When it comes to a property transaction, the encumbrance certificate serves multiple critical areas.

Here are a few purposes that it can serve –

- It clearly establishes the clear title of a property. It enlists all registered dealings over the specified period.

- It facilitates the smooth transfer of the property by establishing the seller as the legal authority to sell the property.

- It also serves the purpose of securing home loans, as banks absolutely require this document before approving mortgage applications.

- The document can also act as a means of fraud protection protecting you from purchasing a property that might be involved in legal disputes or have hidden liabilities.

- It can also serve as the proof of ownership history, creating an official record of how the property has changed hands and been utilized.

Also Read: Home Loan Tax Deductions – A Detailed Guide

Benefits of Obtaining an Encumbrance Certificate

The Encumbrance certificate is non-negotiable in the modern property transfers and allied transactions. It should be a good idea to understand the benefits that you stand to gain with the encumbrance certificate.

Here are a few benefits of the encumbrance certificate –

- Title verification – The EC offers a 30 year history of all registered transactions conducted on a property. You can even get a customised report as well. This will make sure that there are no hidden claims or disputes affecting your ownership rights.

- Fraud prevention – With the complete verification of all the past transactions, you can be assured of the legitimacy of the property. This will help you protect yourself from fraudulent sellers or disputed titles.

- Loan eligibility – Banks and financial institutions require the EC before sanctioning home loans. A clear encumbrance certificate will make sure that the sanction of the loan can speed up. You may also get better interest rates.

- Transaction security – It offers you the security of transactions. The certificate would reduce the transaction risks substantially.

- Ownership transfer – The EC clarifies the chain of ownership, making property mutations and title transfers smoother during purchase or inheritance proceedings.

When you apply for the encumbrance certificate, the sub registrar of the specific region in Kerala issues it in either of the two types of forms. Understanding the exact type of the certificate is crucial as it will help you interpret it accordingly.

Read More: NRI Real Estate Investment in India

Types of Encumbrance Certificate

Form 15 – Property with encumbrances

Form 15 is issued when a property has any registered transactions during the specified search period.

The transactions covered under the form 15 include

- Sale deeds and purchases

- Mortgage deeds (loans from banks or individuals)

- Gift deeds or inheritance documents

- Lease agreements

- Court attachments or legal claims

- Partition deeds (in case of jointly owned properties)

- Relinquishment deeds

The form 15 should not mean the property under question has any issues or problems. It simply lists out the registered dealings that the property has gone through the past 30 years.

Form 16: Nil Encumbrance Certificate (Clear Property)

Form 16 is typically called a Nil Encumbrance certificate. It is issued when a property has no registered encumbrances or transactions during the selected search period. This certificate indicates that the property is completely clear of legal and financial liabilities within the specified timeframe.

A Form 16 certificate is particularly valuable because it proves the property has remained undisturbed through the search period—typically 13 or 30 years—without any mortgages, lease agreements, or court claims.

Limitations of Form 15 and Form 16

Both Form 15 and Form 16 reflect only registered transactions. Unregistered mortgages, oral agreements, family disputes, or Power of Attorney arrangements may not appear on the EC. Therefore, while Form 16 indicates a clean title within the search period, independent legal verification is still advisable before finalizing any significant property transaction.

Why is an Encumbrance Certificate Essential for Home Loan Approval?

Banks and non-banking financial institutions consider the encumbrance certificate a non negotiable document for their loan approval process.

Here are a few reasons why it is considered such an important document –

- The banks take a legal claim on your property when lending you. Before doing this, the bank would want to verify that the title is clear.

- The certificate also lets the banks know if the property has already been previously mortgaged to other lenders, whether there are outstanding court cases affecting the title, or whether the current owner has the legal right to pledge the property as security.

- Having a clean form 16 can help you get an accelerated loan approval. Banks view properties with nil encumbrances as lower-risk collateral, which can translate into faster disbursals and potentially more favorable loan terms.

Also Read: Fair Value of Land in Kerala

How to Get an Encumbrance Certificate in Kerala?

Kerala is known to have one of the highly sophisticated online property registration processes. This should allow you to apply for an EC entirely through digital channels without visiting the Sub-Registrar’s Office.

Here is how to get encumbrance certificate online in Kerala-

Step 1: Navigate to the official portal at https://pearl.registration.kerala.gov.in using any standard web browser (Chrome, Firefox, or Safari).

Step 2: Click on the “Certificates” tab in the main menu, then select “Application for Encumbrance Certificate.”

Step 3: When prompted, click “Yes” to proceed to the application page.

Step 4: You’ll need to verify your identity. Enter your registered mobile number and the captcha code displayed on the screen, then click “Send OTP.”

Step 5: Enter the one-time password (OTP) that arrives on your mobile phone to verify your identity.

Step 6: The application form will now load. Fill in the following details:

- District: Where the property is located

- Sub-Registrar’s Office (SRO): The specific SRO that registered your property

- Document Number or Survey Number: From your property’s sale deed

- Property Description: Village, taluk, extent (area in cents or square feet)

- Search Period: Select the years you want the EC to cover (typically 13 or 30 years)

- Purpose of Certificate: Specify whether it’s for loan, sale, purchase, or other purposes

- Owner’s Name: Enter exactly as it appears in the property deed

Step 7: Read the declaration and agree to the terms by checking the “I Agree” box.

Step 8: Click “Submit Application” to complete your submission. The portal will display a confirmation page with your Transaction ID—save this ID as you’ll need it for tracking.

Also Read: E-Rekha Kerala Land Records

Documents Required to Obtain an Encumbrance Certificate

To apply for the encumbrance certificate, you should submit the following documents –

| Document | Purpose |

| Property Registration Document | Proof that property is legally registered |

| Sale Deed / Title Deed | Original or certified copy showing ownership |

| Gift Deed (if applicable) | For properties received as gifts |

| Partition Deed (if applicable) | For properties acquired through family partition |

| Identity Proof | Aadhaar, PAN, Voter ID, or Passport |

| Address Proof | Current residential address verification |

| Duly Filled Form 22 | Application form with all required details |

| Authority Letter | If applying on behalf of property owner |

| Property Possession Deed | Evidence of property possession and boundaries |

Pro Tip: Ensure all documents match exactly with the property registration records. Any discrepancies in names, property descriptions, or details can lead to application rejection or delays.

Also Read: Essential Documents Required to Buy a Property in Kerala

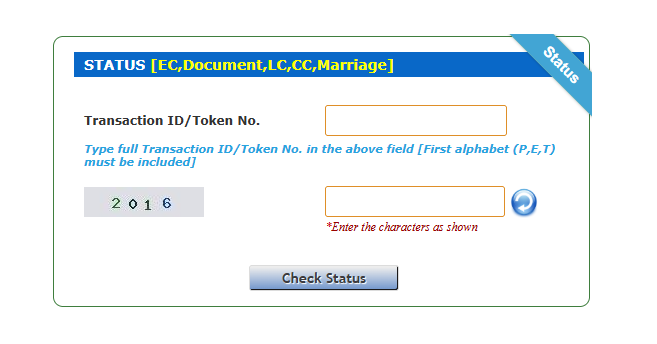

How to Check Your Encumbrance Certificate Status in Kerala?

Once you have submitted your application online or offline for the encumbrance certificate, you can easily check the status of your application in real time.

Here are the steps you should follow –

Step 1: Log into the Kerala Registration Department portal at https://pearl.registration.kerala.gov.in

Step 2: Click on “Application Status / Download” option in the main menu

Step 3: Enter your Transaction ID (received via SMS or email after submission) and the captcha code

Step 4: Click “Check Status” to view real-time updates

The status will show one of the following:

- Pending: Application is under review by the SRO

- Processing: SRO is verifying documents and records

- Ready for Download: Certificate has been processed and is ready to download

- Rejected: Application rejected (usually with specified reasons)

| Processing Timelines: Digitized Records (1990 onwards): 3 working daysPre-digitized Records (before 1990): 7-14 working daysNon-digitized/Old Records: Up to 30 days |

How to Download Your Encumbrance Certificate?

You can download your encumbrance certificate once the status shows the “Ready to Download” status.

You can follow the steps here below to download your certificate –

Step 1: Log into the portal at https://pearl.registration.kerala.gov.in

Step 2: Go to “Application Status / Download”

Step 3: Enter your Transaction ID and captcha, then click “Check Status”

Step 4: Once confirmed as ready, click the “Download” button

Step 5: The EC will download as a PDF file, digitally signed by the Sub-Registrar’s Office

The downloaded PDF is fully valid for all legal and banking purposes. The digital signature can be verified using any PDF reader (like Adobe Reader) by clicking on the signature panel, which will display the government certificate authority stamp.

Viewing and Verifying Your Encumbrance Certificate in Kerala

The downloaded EC should generally contain the following details –

Details of the property

- Full property address and description

- Survey number and extent (area)

- Village, taluk, and district information

- Boundary specifications

History of transactions

- Chronological list of all registered transactions

- Registration dates and document numbers

- Nature of each transaction (sale, mortgage, gift, etc.)

- Names of all parties involved in each transaction

- Consideration amount (if applicable)

Encumbrance status

- Clear statement of whether property is free from encumbrances or has active claims

- Details of any mortgages, leases, or court attachments

- Current lien holders (if any)

| A few tips for verification: Cross-check all property details with your sale deedVerify that your name appears correctly as the ownerReview the transaction history for any unfamiliar or fraudulent entriesEnsure the document is digitally signed by the authorized Sub-Registrar |

What is a Non-Encumbrance certificate?

The encumbrance certificate shows all the registered dealings of the property under question. On the other hand, a non encumbrance certificate shows that the property is free form any encumbrances.

The certificate is issued when you specifically need to prove the property has no active claims or mortgages. In practice, Form 16 (Nil EC) and Non-Encumbrance Certificate are often used interchangeably, though some states have specific legal distinctions.

Difference Between Encumbrance and Non-Encumbrance Certificate

The table below should give you a clear idea on the differences between the encumbrance and non encumbrance certificates.

| Feature | Form 15 | Form 16 |

| Issued When | Property has registered transactions | No transactions during period |

| Encumbrances | May have active claims/mortgages | Property is completely clear |

| Time to Obtain | 3-7 days (faster) | 3-7 days (faster) |

| Use Case | Properties with history of dealings | Ancestral or undisturbed properties |

| Loan Approval | Requires detailed verification | Faster approval process |

| Risk Level | Requires deeper due diligence | Lower perceived risk |

Wrapping Up

The encumbrance certificate is much more than just a legal requirement. It acts as a legal shield against the frauds in property transactions. The Kerala Registration Department’s digitalized system has made this process remarkably simple, affordable, and swift.

If you’re planning a property purchase in Kerala, don’t wait for the bank to ask for your EC—apply for it immediately. Need professional guidance on property transactions, documentation, or real estate investments in Kerala? Visit Navera Builders, one of the leading builders in Thrissur for expert consultation from professionals who understand Kerala’s real estate landscape inside out.

FAQs

What is the application fee for getting an Encumbrance Certificate?

The application fee is just Rs. 15, making it extremely affordable. Additional charges depend on your search period (Rs. 105 for 5 years, Rs. 265 for 6-30 years).

How long does it take to get an Encumbrance Certificate?

For digitized records (1990 onwards), it takes 3 working days. For pre-digitized records, it can take 7-14 working days. Very old records may take up to 30 days.

What does an EC for a home loan include?

It includes a 30-year transaction history, showing all registered dealings, current ownership status, and whether any active mortgages or court claims exist against the property.

What is the meaning of the Nil Encumbrance Certificate?

A Nil EC (Form 16) confirms that the property has no registered encumbrances or claims during the search period—essentially proving the property’s title is clear.

What are the risks of not acquiring an Encumbrance Certificate?

Without an EC, you risk purchasing a property with hidden mortgages, court orders, or claims against it. Banks won’t sanction loans without it, and you have no legal protection against undisclosed liabilities.

What are the alternatives to EC for verifying Property Title?

While EC is the primary document, you can supplement it with a title search report from a property lawyer, verification of original sale deeds, and checking with the local revenue office for any pending disputes or revenue dues.